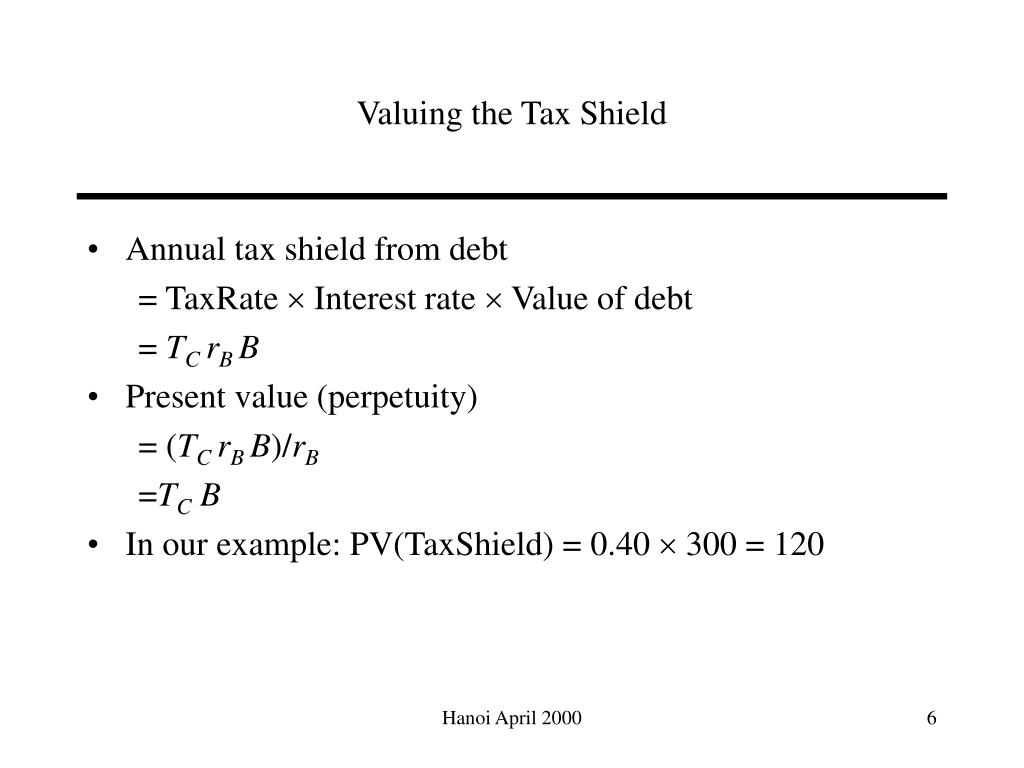

interest tax shield formula

The interest tax shield formula. The TDS rate on fixed deposits FDs is 10 if the interest amount for.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax_shield Interest Tax_rate.

. The formula for calculating the interest tax shield is as follows. Interest Tax Shield Formula. Interest Expense Formula.

It will face a tax of Rs 31200 tax rate of 30 and 04 cess. Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Interest Tax Shield Interest Expense Tax Rate.

If you wish to calculate tax shield value manually you should use the formula below. How much tax do you pay on bank interest. Thus if the tax rate is 21 and the business has 1000 of interest expense the tax shield value of the interest expense is 210.

Thus there is a tax savings referred to as the tax shield. The effect of a tax shield can be determined using a formula. For instance if the tax rate is 210 and the.

Tax Shield Deduction x Tax Rate. As such the shield is 8000000 x 10 x 35 280000. In the valuation of the interest tax shield it capitalizes the value of the firm and it also limits the tax benefits of the debt.

The value can be calculated by the interest expense multiplied by the companys tax rate. Suppose company X owes 20m of taxes pays 5m. This can lower the effective tax rate of a business or individual which is especially important when their reported.

What is the interest tax shield this company is going to get by using debt. 3 is the formula of its present value. Tax Shield Amount of tax-deductible expense x Tax rate.

1 It is based on the. Its 50000 debt load has an interest tax shield of 15000 or 50000 30 7 7. 2 is the formula for calculating the interest tax shield based on the Modigliani and Miller theory Eq.

For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. What is the formula for tax shield. Tax Shield 5000 40000 10000 35.

You can use the following formula to calculate the interest tax shield. The intuition here is that the company has an 800000. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG.

Tax Shield is calculated as. Here is the formula to calculate interest on the income statement. Interest expenses are considered to be tax-deductible.

Interest Tax Shield Tax-Deductible Interest Amount Tax Rate For instance if your allowable interest tax cost is. This is equivalent to the 800000 interest expense multiplied by 35. Tax Shield formula.

The intent of a tax shield is to defer or eliminate a tax liability. This is usually the deduction multiplied by the tax rate. Interest Tax Shield Interest expense Tax Rate.

Thus the adjusted present value is 115000 or 100000 15000. In the year 2020 the company had interest equal to 25000 and in 2021 the interest is 28000. To learn more launch.

Ppt Capital Budgeting With The Net Present Value Rule 3 Impact Of Financing Powerpoint Presentation Id 1428671

Nopat Formula And Calculator Step By Step

What Is The Depreciation Tax Shield The Ultimate Guide 2021

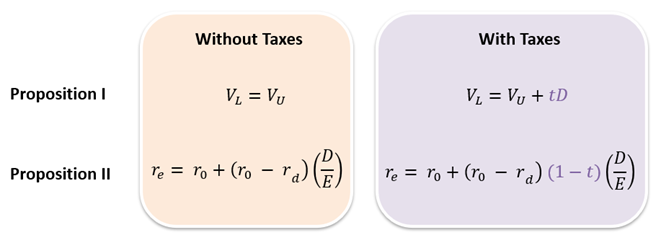

Modigliani Miller Propositions Analystprep Cfa Exam Study Notes

Risky Tax Shields And Risky Debt An Exploratory Study

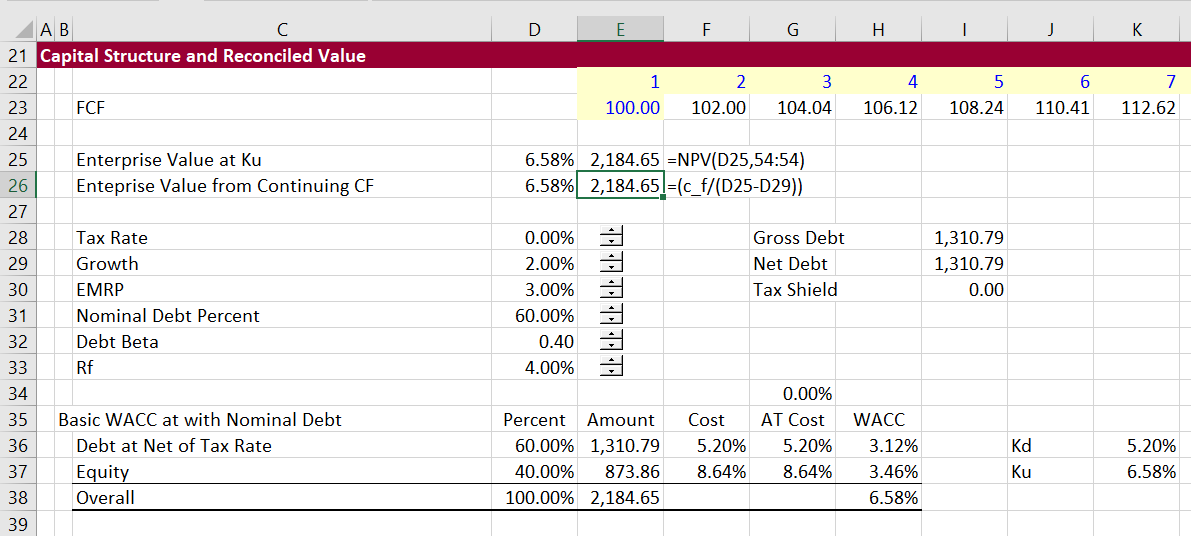

Proof Of Valuation Using Ku Or Wacc Without Interest Tax Shield Edward Bodmer Project And Corporate Finance

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

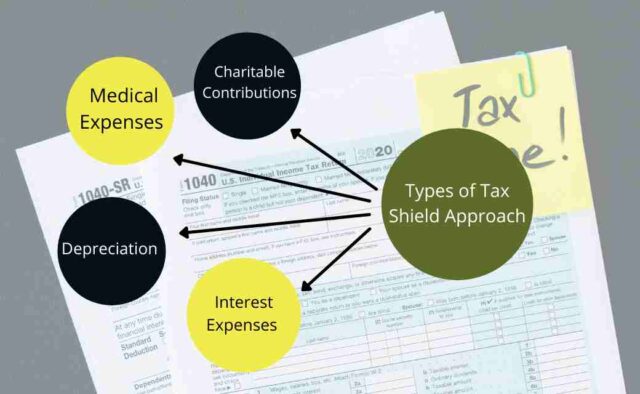

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

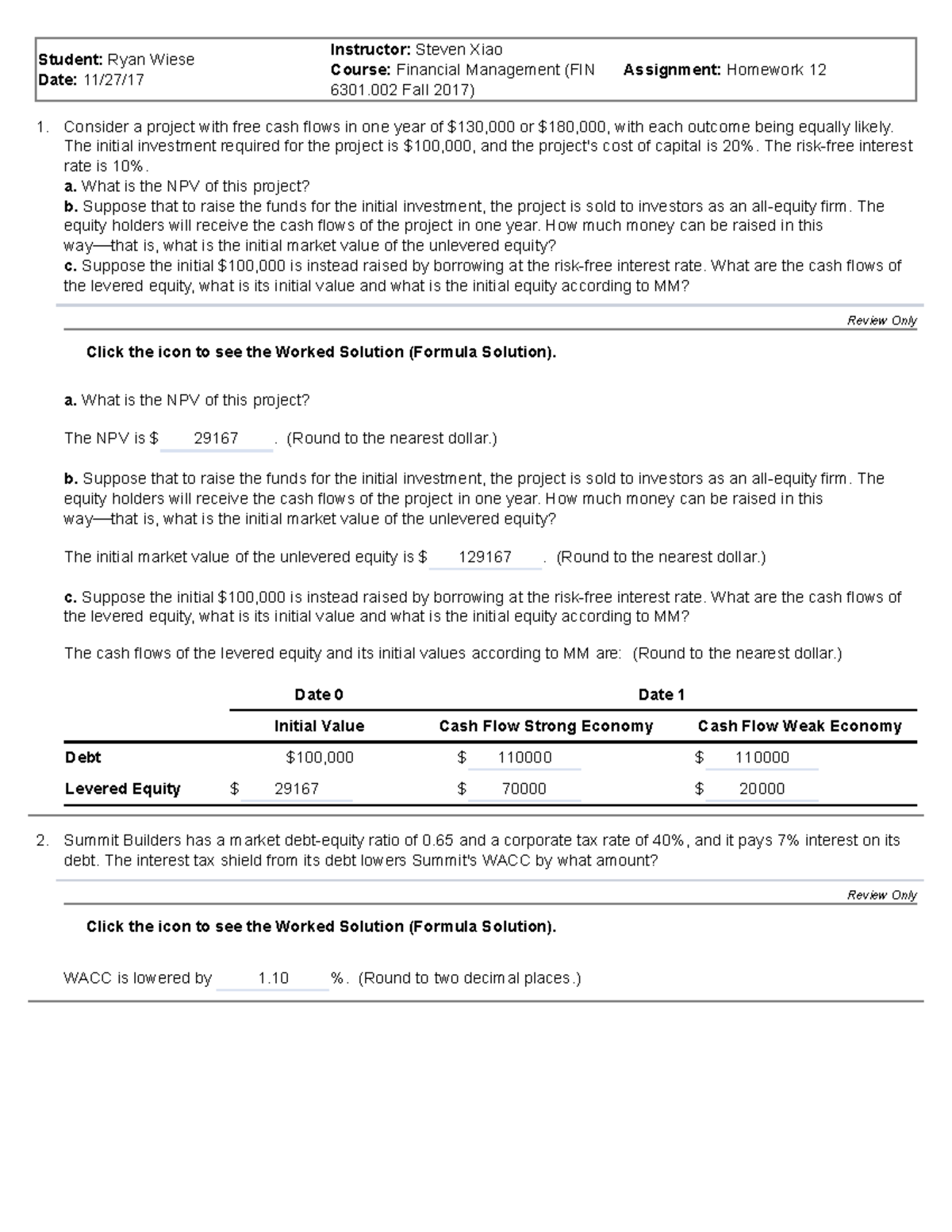

Berk Chapter 15 Debt And Taxes

Wk13 Hw Hw 13 1 2 Student Ryan Wiese Date 11 27 Instructor Steven Xiao Course Financial Studocu

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Interest Tax Shield Formula And Calculator Step By Step

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Using Apv A Better Tool For Valuing Operations

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Interest Tax Shield Formula Ppt Powerpoint Presentation Styles Introduction Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates